2023 has swiftly passed, and for many landlords, it has certainly been a year filled with "challenges."

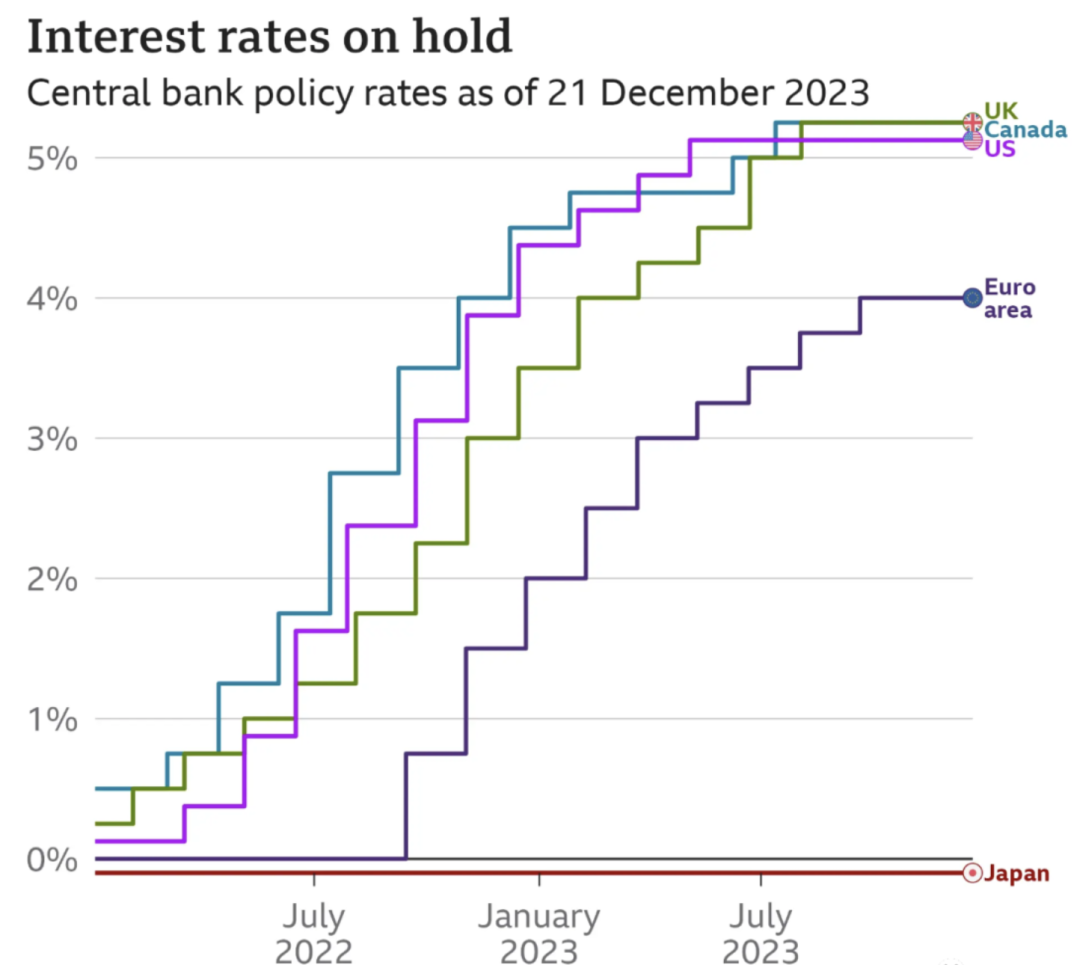

On one hand, after the Bank of England raised interest rates 14 times consecutively, it unexpectedly announced maintaining the base rate at 5.25%, avoiding a 15th hike.

Let's start with the political landscape. The most important issue for landlords to monitor in 2024 is the UK General Election and the promises made by the main political parties concerning housing. Since the beginning of the year, there has been widespread speculation about the election date. Both Labour and the Liberal Democrats have urged the Conservative government to hold the election in May. However, on January 4th, during a visit to a youth center in Mansfield, Prime Minister Rishi Sunak told the BBC that his team is considering holding the election "later this year."

Tips:

As we all know, the UK has long struggled with a housing shortage, making housing policy a key area for all political parties. It's worth keeping an eye on which party proposes beneficial measures.

In May last year, the UK officially submitted the Renters' Reform Bill to the House of Commons, which is currently under parliamentary review. This bill is part of the most significant reform in England’s private rental sector in a generation. If passed, it will provide greater protections for existing tenants.

At the same time, landlords will benefit from easier processes for evicting irresponsible or anti-social tenants.

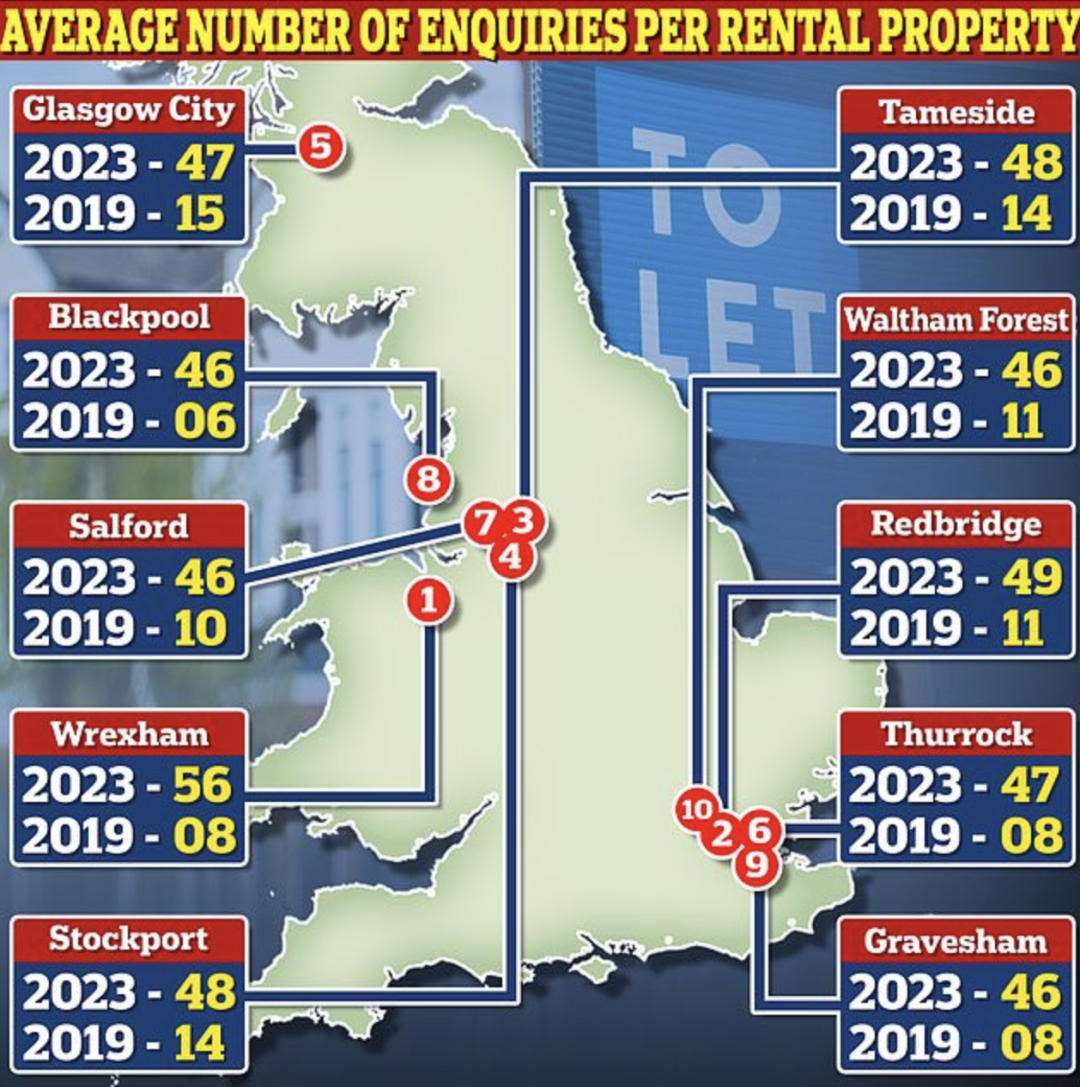

The rental market across the UK has experienced severe supply shortages. According to Rightmove, the number of inquiries per rental property doubled in 2023, from 6 per property in 2019 to 20 per property in 2023.

In some highly sought-after areas, inquiries per property reached as high as 50.

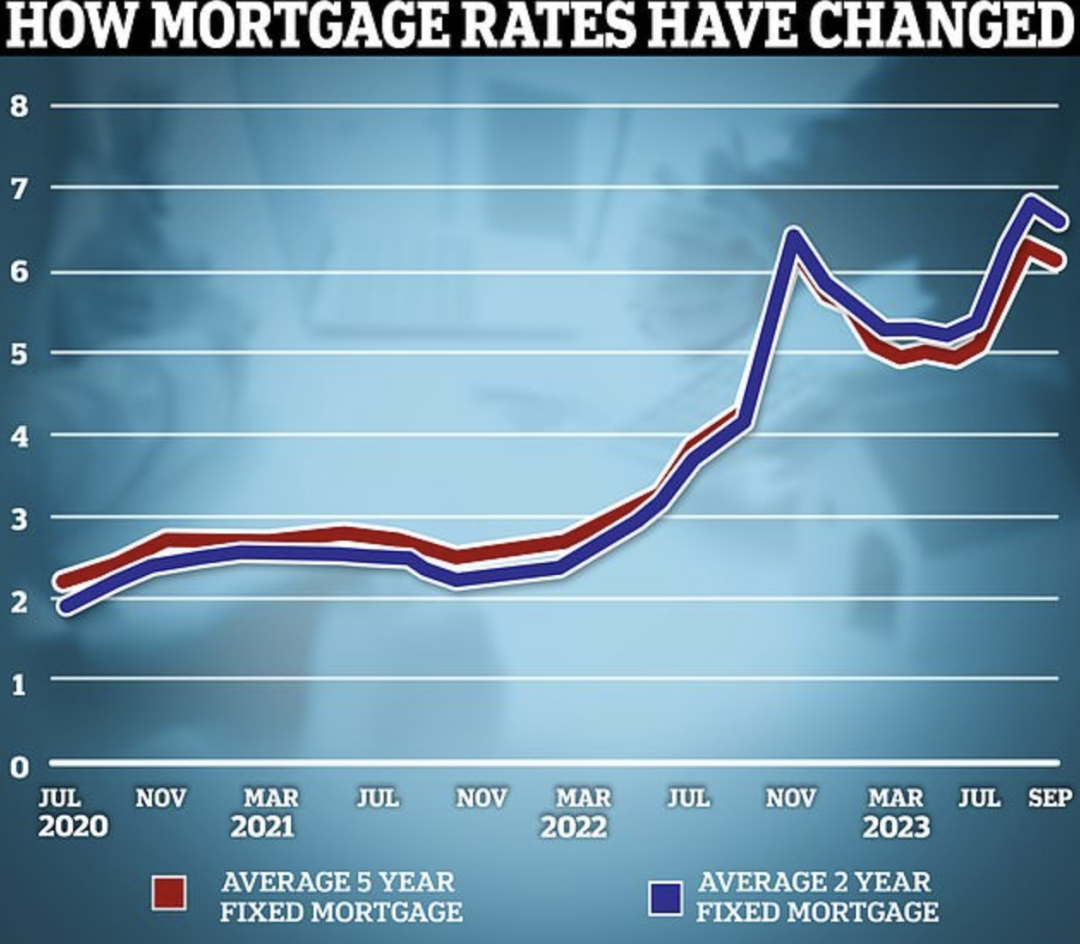

Good news for landlords: mortgage rates have been decreasing in recent months. Some economists predict that if inflation continues to fall, the Bank of England may lower interest rates as early as spring 2024. With increasing market expectations of rate cuts, fixed-rate mortgages from some UK banks have already seen a decline.

Tips:

Market expectations for interest rates are reflected in swap rates, which are influenced by long-term market forecasts for the Bank of England’s base rate, the wider economic environment, internal bank goals, and competitor pricing. Swap rates have already fallen: the five-year swap rate is 3.36%, while the two-year swap rate is 3.99%. In July last year, the five-year swap rate was over 5%.

Summary for Today:

Looking ahead to the new year, most believe that with inflation under control and an improving economic environment, the market is stabilizing. Coupled with the likelihood of further decreases in mortgage rates and stable to rising rents, 2024 is beginning with a lot of good news for landlords.